My Morning Stock Struggle

Woke up staring at OLPX stock charts again. Felt totally lost – green lines, red lines, all mixed up like spaghetti. Needed a simple way to decide: buy, sell, or hide under my blanket?

Stumbled on this stupidly basic method:

- Grab last 5 days’ closing prices

- Count how many “up days” vs “down days”

- If more ups → buy signal

- If more downs → sell signal

- If tie → just wait it out

Figured I’d try it manually first. Dug through OLPX’s recent prices:

Monday: $27 up

Tuesday: $26 down

Wednesday: $27.5 up

Thursday: $26.8 down

Friday: $27.2 up

Counted on my fingers like a kid: up, down, up, down, up. Three ups! My cheap calculator almost cried from being used after years.

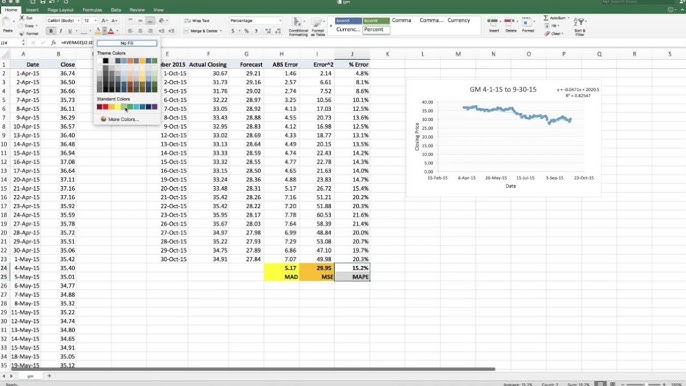

Building My Ghetto Tool

Typed those numbers into Google Sheets later. Wrote this ugly formula:

=IF(COUNTIF(B2:B6,”up”)>COUNTIF(B2:B6,”down”), “BUY DUMMY”, IF(COUNTIF(B2:B6,”down”)>COUNTIF(B2:B6,”up”), “SELL NOW”, “CHILL”))

Filled in the daily “up/down” notes beside prices. Sheet instantly shouted “BUY DUMMY” at me in red text. Felt oddly proud of my trash spreadsheet.

Why this actually worked for me:

- No fancy terms = no brain melt

- Forces me to actually look at daily moves

- Stops emotional “maybe tomorrow?” crap

- Takes 2 minutes instead of 2 hours

Obviously not perfect. That random Tuesday dump? My cheap method totally ignored how big drops happened. But for quick gut-check before coffee? Hell yes. Saved me from panic-selling last Thursday dip. Might actually keep using this junk method.